How to Calculate Travel Nursing Net Pay

Calculating net pay is an important step in comparing competing travel nursing pay packages and ultimately deciding whether or not to accept a particular travel nursing job. The importance of net pay is relatively unique to travel nursing. This is due largely to the fact that levels of tax-free compensation vary so greatly. However, there are other important factors to consider. Here we’ll discuss the factors that affect net pay and provide a strategy for calculating it.

What is net pay and how should it be calculated?

It’s important to define net pay because we want to make sure that we’re making apples-to-apples comparisons when comparing compensation packages. The standard and perhaps best approach is to focus on weekly net pay. Weekly net pay is the estimated net amount that will be deposited to the travel nurse’s account for working the contracted weekly hours. While this might seem really straightforward, you must be careful to clearly define the parameters.

Remember, the pay package can be comprised of many variables. As a result, you may run in to some recruiters who factor in variables like travel stipends or medical benefit costs to their weekly net pay quotes. However, these variables are most likely not going to be paid on a weekly basis. Recruiters do this because they’re intent on portraying the full value of their compensation package.

While this may seem disingenuous, this approach is not without merit. Recruiters are concerned that a centralized focus on weekly net pay might overshadow some of the other compensation variables they’re offering. For example, they might be offering a much higher travel stipend than other agencies, or they might provide top-notch medical benefits that are more expensive than others, or they might be offering a completion bonus. This is why it’s so important to get your compensation quotes in writing. In doing so, you’ll be able to run equal calculations and make your own comparisons.

For our purposes here, we’re defining weekly net pay as only the amount of money that will be deposited to the travel nurse’s bank account for working the contracted hours. However, you must remember to consider all of the other variables when comparing the total value of competing pay packages.

Now that we’ve defined net pay, let’s take a basic look at how it’s calculated. First, we’re going to calculate the gross taxable wage per week. Next, we’re going to calculate the weekly taxes that will be paid on the gross taxable weekly wage and subtract the taxes from the gross weekly taxable wage. Finally, we’re going to add the remainder to the tax-free stipends to arrive at the final weekly net pay figure.

Sample Travel Nursing Pay Packages

Let’s begin with two sample pay packages so that we have something to refer to throughout our discussion.

Sample #1

The assignment is for 13 weeks at 36 regular hours per week for a total of 468 anticipated hours. The agency offers the following:

Taxable base rate: $20/hour

Tax-free housing stipend: $1900/month (paid weekly)

Tax-free M&IE stipend: $250/week

Sample #2

The assignment is for 13 weeks at 36 regular hours per week for a total of 468 anticipated hours. The agency offers the following:

Taxable base rate: $15/hour

Tax-free housing stipend: $2100/month (paid weekly)

Tax-free M&IE stipend: $300/week

For the purpose of calculating weekly net pay, the first thing we have to do is breakdown the monthly housing stipend to a weekly figure. It’s highly recommended that you require your recruiter to perform this calculation for you in order to avoid any miscommunication. However, If the agency is portraying this figure properly, then you should be able to multiply the monthly figure by three and divide by 13 in order to arrive at the weekly calculation. Remember, three months is 13 weeks and there are 4.33 weeks in a month. So we’re looking at $438.46 for Sample #1 and $484.62 for Sample #2.

Our next step is to calculate the total weekly dollar for the tax-stipends. Essentially, we need to add the housing stipend to the M&IE stipend. For Sample #1 we’re looking at $438.46 (housing) + $250 (M&IE) for a total of $688.46 per week. For Sample #2 we’re looking at $484.62 (housing) + $300 (M&IE) for a total of $784.62 per week.

How to calculate the estimated taxes for travel nursing pay

Now we’re ready to calculate the taxes that will be taken out of the weekly pay check. We need two things to accomplish this. First, we need the gross weekly taxable wage. To calculate the gross weekly taxable wage we simply multiply the taxable base rate by the number of contracted weekly hours. For Sample #1 we’re looking at $20 * 36 hours for a total of $720 per week. For Sample #1 we’re looking at $15 * 36 hours for a total of $540 per week.

Next, we need to calculate the estimated taxes that will be paid on the weekly taxable income. To accomplish this, many recruiters and travel nurses will rely on a ball-park tax rate figure. For example, they might estimate that the tax burden will be 20%. They will then multiply the gross weekly taxable wage by 20% to determine the estimated tax burden. So for Sample #1 we’re looking at .2 * $720 = $144.

This approach is not recommended for two reasons. First, taxes are progressive. This means that the more money you make, the higher your tax rate is and vice-versa. Second, states have substantially different state tax rates. Both of these issues can throw your calculations off significantly.

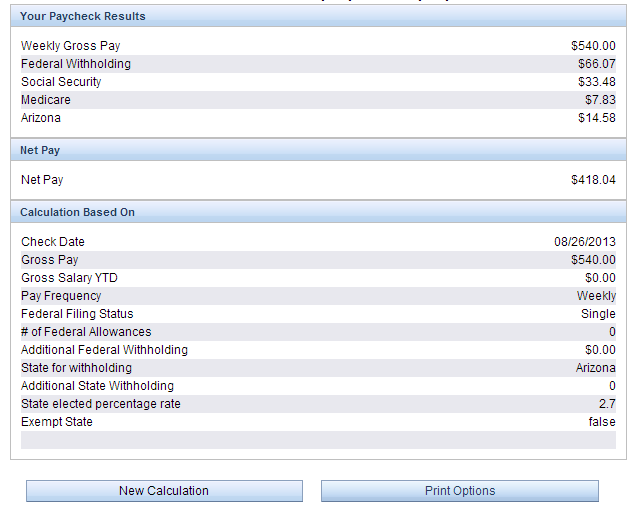

Using an online paycheck calculator is a much better alternative. The most popular online paycheck calculator is found at paycheckcity.com. From their homepage menu you can select Calculator, then Standard, then Hourly Paycheck. Enter the information as applicable and select Calculate at the bottom of the calculator. It will provide a much more accurate estimate of your tax burden.

Below are images of our results for Sample #1 and Sample #2. You can see that we’ve selected Arizona as the state and you can also see the other parameters we used for our tax status. Yours maybe different than what we’ve selected so be sure to enter parameters that are unique to your situation. This is part of the beauty of paycheck calculators.

Calculating net pay

As mentioned above, we simply subtract the estimated weekly taxes from the weekly taxable wage and add the remainder to the total weekly tax-free stipends to calculate weekly net pay for a contract. For Sample #1 we’re looking at $720 – $167.59 = $552.41 + $688.46 = $1240.87 net weekly pay. For Sample #2 we’re looking at $540 – $121.96 = $418.04 + $784.62 = $1202.66 net weekly pay.

As you can see, Sample #1 offers the higher net pay. However, you must still remember to account for the all of the remaining compensation variables when determining which contract offers the better deal.