How Much do Travel Nurses Make? The Definitive Guide for 2020

“How much do travel nurses make?” This is a very complex topic. Unfortunately, the internet is littered with oversimplified and often duplicitous answers to the question. As a result, travel nurses are often caught off guard with unexpected results. In this article, we’ll take an in-depth look at how much traveling nurses make so you can set expectations accordingly.

For starters, it’s important to note that this article provides pay information for traveling Registered Nurses. However, the same factors apply across all modalities in travel healthcare. Therefore, travel therapists and travel techs can also benefit from this information.

Introduction – How Much Do Travel Nurses Make?

The information available on travel nursing pay lacks the substance necessary to help those interested in travel healthcare make a truly informed decision. Most importantly, travel nurses incur costs that permanent employees do not.

Moreover, travel nurses forgo benefits that permanent employees commonly receive. Additionally, travel nursing pay varies dramatically by region and specialty.

This article provides examples of bad information so travel nurses will know what to watch out for. Next, this article describes some of the costs that travel nurses incur.

Find your next travel healthcare job on BluePipes!

Additionally, the article defines three distinct categories of travel nurses. It also distinguishes the variances in travel nursing pay by region and specialty.

Finally, the article provides examples of pay based on real bill rates provided by real travel nursing companies. After you read the article, we hope that you’ll be able to determine how much you can make as travel nurse with far greater accuracy.

Table of Contents

Our travel nursing salary guide for 2020 is packed with information. Below is a table of contents to help you navigate. Simply select a link and you’ll jump to the beginning of the topic.

- Bad Information on Travel Nursing Salaries

- Why Travel Nurse Salary Information is Often Incorrect?

- Travel Nursing Pay Packages Versus Permanent Pay Packages

- The Costs that Travel Nurses Incur

- Factors that Influence How Much Travel Nurses Make

- 3 General Categories of Travel Nurse

- The Average Annual Salary for a Travel Nurse

- High-End Annual Salary for a Travel Nurse

- Low-End Annual Salary for a Travel Nurse

- What About Overtime for Travel Nurses?

- How Much Do Travel Nurses Make Including Overtime?

- Will I Make More Money as a Travel Nurse?

Bad Information on Travel Nursing “Salaries”

Let’s look at some examples of bad information on how much money travel nurses make. Again, we’ll point out the problems with each example so you know what to watch out for.

Example 1 – Check the Math

When we originally wrote this article, we did a Google search for: how much do travel nurses make? At that time, Google provided the “Quick Answer Box” pictured below:

Consider the Source

First, this answer comes from a lead generator called TravelNursing.org. Lead Generators collect your contact information and sell it to third parties.

There is nothing wrong with this, but it’s not an unbiased source. They have an incentive to glamourize travel nursing so that you enter your contact information.

Travel Nurses Don’t Earn a Salary

Second, travel nurses do not receive a “salary.” Instead, travel nurses receive an hourly wage. This is an important distinction. As we’ll see below, agencies only pay travel nurses when they work.

The fact that this lead generator uses the term “salary” is not their fault. In fact, you may have noticed that we are using the term “salary” as well.

Free: Universal Job Application and Credential Management for travelers.

The reason is that Google uses the term “salary” in their recommended search terms. Therefore, we need to use the word salary in order for you to find this article in the search results.

The Math Doesn’t Add Up

Third, the math doesn’t add up. We have no idea what they mean by a “48-hour work year “. So, let’s assume they mean a “48-hour work week “.

At an average of $40 per hour and a total of $75,000 for the year, that means the travel nurse would work 39 weeks and have 13 weeks off. That’s possible. However, the average travel nurse does not work 39 48-hour weeks.

Now let’s assume they mean a “48-week work year” instead of a “48-hour work year”. At $40 per hour, the traveler would need to work 40 hours per week for 48 weeks in order to get close to the quoted annual income of $75,000. That’s possible.

However, RNs typically work 12-hour shifts, so it would be really rare for them to achieve these numbers. I guess it’s fair to say that even Google gets confused by travel healthcare pay!

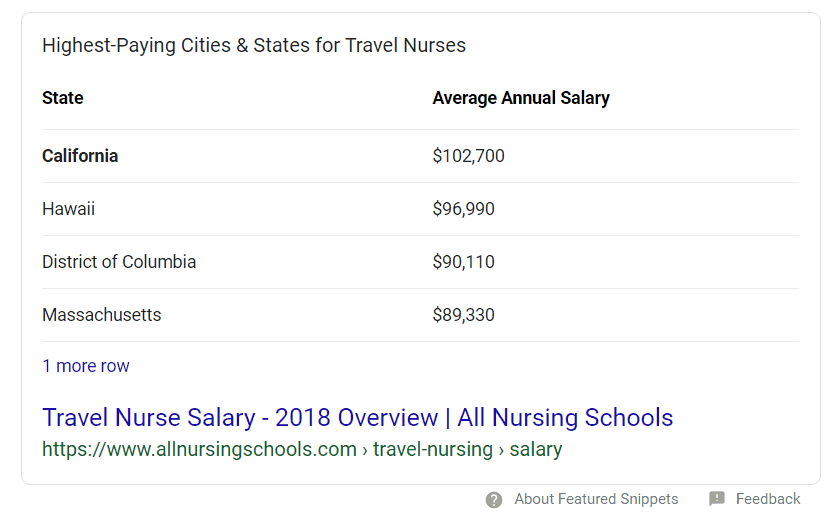

Example 2 – Substituting Permanent Salary

When we updated this article for 2020, we did a Google search for: how much do travel nurses make? At that time, Google provided the “Quick Answer Box” pictured below:

Again, the source is a lead generator. However, this lead generator sells your contact information to nursing schools. Either way, nurses should be extra cautious with the information they find on lead generation websites.

Using Permanent Nurse Pay in Place of Travel Nurse Pay

In this case, the lead generator substitutes the pay for permanent nurses as the pay of travel nurses. Unfortunately, you wouldn’t know this by looking at Google’s “Quick Answer Box”. You actually have to read the entire article very closely in order to catch it.

This is a huge mistake! As we’ll discuss further below, the pay for travel nurses and the pay for permanent nurses are entirely different. As a result, thousands of travel nurses have received faulty information.

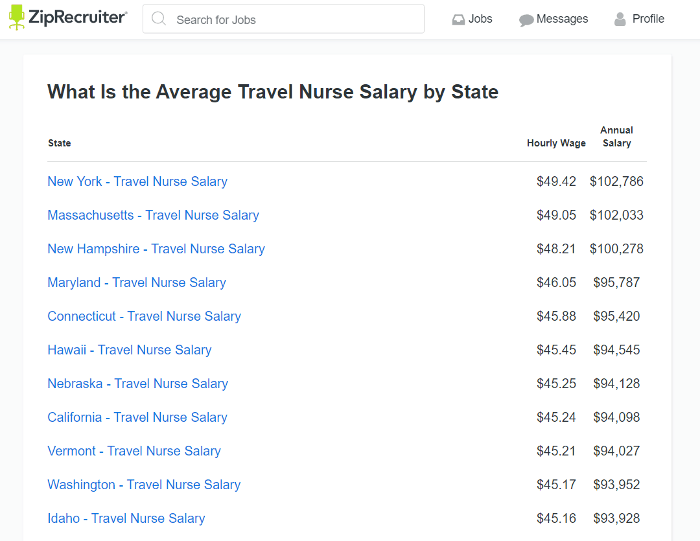

Example 3 – Work Weeks and Algorithms

Our third example comes from ZipRecruiter. ZipRecruiter is a large and well-known job board. As a result, you might think they are reputable. However, ZipRecruiter has no expertise in travel healthcare and it shows.

Below is an image from a page on ZipRecruiter titled “What Is the Average Travel Nurse Salary by State”.

How Much Do Travel Nurses Work?

This information is riddled with inaccuracies! First, if we crunch the numbers, then we find that a travel nurse must work 40 hours per week for 52 weeks to achieve the “Annual Salary” that ZipRecruiter claims the average travel nurse makes.

First, travel nurses do not commonly work 40 hours per week. The standard contract is 36 hours per week for 13 weeks. A very small percentage of contracts are for 40 or 48 hours per week.

Second, travel nurses almost always experience unpaid downtime when they switch contracts. Also, travel nurses, like everyone else, take time off. They rarely work a full work week every single week of every single year.

Additionally, PTO and sick pay are very uncommon for travel nurses. This means that travel nursing companies pay travel nurses only when they work.

Is it possible for a travel nurse to work 40 hours per week for 52 weeks per year? Yes, absolutely. Is it likely? No, absolutely not. Is it the “average”? Not a chance!

How Many Weeks Per Year Do Travel Nurses Work?

Our research indicates that the average travel nurse works 46 weeks per year. This comes from our own experience at healthcare staffing companies where we tracked the work of thousands of travel nurses.

If we substitute 46 weeks for 52 weeks in ZipRecruiter’s calculation, then the difference is stark. For example, if a travel nurse works 36 hours per week for 46 weeks in New York at the average hourly rate ZipRecruiter provides, then the travel nurse would make $81,840. ZipRecruiter reports $102,786.

That’s a difference of $20,946. That’s enough money to devastate any middle-class individual, let alone a family.

If a travel nurse works 40 hours per week for 46 weeks in New York at the average hourly rate reported by ZipRecruiter, then they would make $90,933. Again, ZipRecruiter reports $102,786.

That’s a difference of $11,853. Again, this is a significant amount of money. Enough to cause major financial problems for most Americans.

ZipRecruiter’s State Rankings for Travel Nurse Pay are Incorrect

ZipRecruiter’s state rankings for travel nursing pay are also glaringly inaccurate. For example, Hawaii is notorious for low paying assignments. Yet ZipRecruiter ranks Hawaii as the 6th highest paying state.

Meanwhile, there is no way Nebraska pays more than California. In fact, California is widely regarded as the highest paying state.

Where Does ZipRecruiter Get Their Information?

ZipRecruiter presents this information as if it’s fact. However, if you read the fine-print, you’ll see what’s really going on.

ZipRecruiter states that these figures are estimates. Also, they are not verified by employers. Moreover, they are calculated by an “algorithm”. Hey, ZipRecruiter, your algorithm is broken.

Why Travel Nurse Salary Information is Often Incorrect?

We haven’t even discussed the major inaccuracies yet, but, as you can see, much of the information available on travel nurse salary is wildly inaccurate. There are a few reasons for this.

First, many resources lack expertise in travel nursing. However, they want to attract travel nurses to their website for one reason or another. So, they end up publishing bogus information just to get traffic.

Second, most of the information comes from sources that have an interest in glamorizing the career. These services include lead-generators and healthcare staffing agencies among others.

Third, many resources publish overly simplistic information in order to get page-views and back-links. However, there is no simple way to account for the unique aspects of travel nursing pay so the information ends up being inaccurate.

So, let’s set the record straight. In the next few sections, we’ll take a look at the main factors to consider when evaluating how much money travel nurses make.

Travel Nursing Pay Packages Versus Permanent Pay Packages

First, it’s important to provide some context. Generally, our fundamental understanding of pay is based on pay for permanent jobs.

For example, we accept that permanent jobs have a basic set of costs associated with them. The cost of getting to and from our place of employment is one example.

Additionally, when someone quotes a salary to us, we assume that additional benefits, like medical benefits, are also included. This is especially true if we’re talking about skilled professionals like Registered Nurses.

Why is this important? Because travel nursing pay is entirely different. Therefore, when someone says that the annual salary for a travel nurse is $75,000, it’s a big mistake to measure that quote against a permanent job.

Travel Nursing Pay Packages Are Variable

It’s important to recognize that travel nursing pay-packages often vary depending on the benefits the travel nurse receives. For example, if you don’t take a company’s medical benefits, then the company might actually pay you more money.

Ultimately, many of the “free” benefits that travel nursing agencies advertise are simply services that agencies provide for a price. As a result, it’s quite common for agencies to “walk back” pay quotes that they publish publicly.

For example, you might see a job posting that advertises pay of $2,500 per week. You might contact the agency and let them know you need medical benefits and reimbursements for various costs like licenses and certifications. The recruiter might reduce the weekly pay by an equal amount to cover these costs.

It’s important to note that not all travel nursing agencies operate this way. However, a significant number of them do.

Obviously, this is much different than permanent pay packages. Therefore, you can’t truly rely on publicly available travel nursing pay packages to gain a clear understanding of travel nursing salaries.

Factoring In a Travel Nurse’s Costs Is Important

Perhaps more importantly, travel nurses incur costs that permanent nurses do not. Therefore, it’s extremely important to account for these costs when discussing how much money travel nurses make.

For example, most travel nursing companies provide a “travel stipend”. It’s intended to cover the travel nurse’s travel related costs. However, it’s rarely enough to cover all the travel nurse’s travel costs. As a result, the nurse pays out of pocket.

We’ve covered the costs that travel nurses incur extensively in a previous article. Here is a basic overview:

1: Travel Nursing Tax Home Expenses

Tax-free reimbursements are a big part of travel nursing pay packages. However, you must maintain a tax-home to qualify for tax-free reimbursements.

There are several ways to maintain a tax home. We covered the issue extensively in our article on tax-homes for travel nurses. That said, maintaining a tax home requires a certain level of expenses no matter how you do it.

For example, the most common and easiest way to maintain a tax-home requires that you pay “duplicate living expenses”. This means that you pay “fair market value” for rent or a mortgage at your tax-home.

Therefore, you’re paying lodging expenses at your tax-home and at your travel nursing assignment. Obviously, that’s a significant expense that you do not incur as a permanent nurse.

It’s possible for you to avoid duplicate living expenses. However, it’s quite complicated. We provide further details below.

2: Travel Expenses

Traveling between contracts costs money. Whether you’re driving, flying or taking the bus, you will incur expenses for lodging, food and transportation.

Moreover, many travel nurses make routine trips home during their assignments. Again, these costs add up quickly.

3: License and Certification Expenses

Travel nurses commonly obtain licenses in multiple states. Licenses typically cost several hundred dollars a pop. Travelers must also maintain their certifications. Unlike permanent employers, travel nurse staffing agencies don’t always cover these expenses.

4: Medical Benefits

As a travel nurse, you may want to secure your own medical benefits. This is because travel nurses routinely work with multiple agencies in order to land the jobs they want in the locations they want.

Free eBook: How To Negotiate Travel Nursing Pay

Working with multiple agencies means that you could potentially change insurance companies often. This can interfere with your continuity of care, so securing your own benefits becomes an attractive option.

5: The Cost of Low Wages

Travel nursing pay typically includes a relatively low taxable hourly wage. The tax-free reimbursements balance out the pay package.

This means that contributions to your social security retirement benefit are lower. However, don’t worry too much about this as the actual cost is usually negligible.

However, lower taxable wages will also affect unemployment and Workers Compensation/Disability payments. Therefore, if you run into issues that require the use of these safety nets, then this could be a major cost.

6: Lack of Paid Vacation or Paid Sick Leave

The vast majority of travel nursing companies do not offer paid vacation time or paid sick leave. We should consider this a cost if the goal is to measure travel nursing pay packages against their permanent equivalents.

But Don’t Travel Nursing Companies Pay for All of These Things?

I can hear every healthcare staffing agency say, “But we provide almost every one of these benefits for free!” Fair enough. But you can’t add them to the annual salary figures you advertise to travel nurses.

Many resources frame pay packages this way. Unfortunately, it is both specious and ambiguous.

Specifically, if a quote for the annual salary of a travel nurse includes the value of “free housing” and “travel allowance”, then it is undeniably specious. Why? Because these are reimbursements for costs the travel nurse will incur.

Meanwhile, including benefits like 401(k), insurance and CEUs make these quotes ambiguous. This is because we typically wouldn’t include the value of such benefits when quoting how much a permanent employee makes.

Factors that Influence How Much Travel Nurses Make

With all of that in mind, it is certainly possible for travel nurses to make over $100,000 per year. It’s also possible for them to make much less.

How much money you actually make as a travel nurse depends on several key factors. We’ll take a look at those factors next.

Travel Nursing Bill Rates

Bill rates are the hourly rates that agencies can bill their client hospitals for an hour of the travel nurse’s time. Therefore, bill rates are one of the key factors that determine how much an agency pays for a particular job. Please follow this link for more information on travel nurse bill rates.

Travel Nursing Salaries by Specialty

Bill rates for travel nurses vary by specialty. Therefore, pay varies by specialty to some degree. Below is a list of tiers ranked from highest to lowest:

- Tier 1: Cath Lab – It’s in a league of its own.

- Tier 2: ICU, L&D, PICU, NICU, CVICU, ER, OR, PACU

- Tier 3: DOU, SDU, PCU, Telemetry, Intermediate Care, Case Management

- Tier 4: Medical Surgical, Psychiatric, Pediatrics, Post-Partum, Home Health

You will certainly find some overlap on a job-by-job basis. For example, every once in a while, you’ll find a Medical Surgical job paying really high rates. Similarly, certain specialties, like L&D, experience routine spikes in pay rates.

Travel Nursing Salaries by State

It’s true that bill rates for travel nurses vary quite a bit from state to state. However, just because you’re getting paid more doesn’t mean you’re saving more. Remember, the cost of living varies from state to state as well.

California is the perfect example. California definitely has the highest pay rates for travel nurses. However, the major metropolitan areas like San Diego, San Francisco, and Los Angeles are also among the most expensive in the country.

That said, it’s still possible to earn more money in states like California. For example, if you’re willing to skimp on housing accommodations or share accommodations in San Francisco, then you could potentially save more money.

Additionally, if you choose to work in some of the less expensive areas of California like Sacramento, Stockton, Fresno, or Bakersfield, then you can save more because the bill rates are relatively similar to the major metro areas.

Variances in Pay Rates by State and Specialty

While it’s true that certain specialties and states pay more than others, it’s also true that pay rates vary significantly within these categories.

For example, one of our staffing agency partners has ICU travel nursing jobs in California paying as high as $2,804 per week and as low as $1,487 per week. By contrast, the same company has ICU travel nursing jobs in Arkansas paying as high as $2,120 per week and as lows $1,456 per week.

How Work Weeks Affect Travel Nursing Salaries

Like any other hourly job, the amount of time you spend working has an impact on how much you make as a traveling nurse. However, travel nursing is unique in this regard for two reasons.

First, as mentioned above, agencies typically do not offer paid time off or paid sick leave. Second, travel nurses experience time off between contracts and take vacation time.

With that in mind, it’s a good idea to estimate how many weeks you anticipate working in order to properly gauge your annual earning potential. We think a good rule of thumb is 46 weeks. This gives you 6 weeks for travelling between contracts, vacations and any sick days you may incur.

We will run some pay calculations below so you can see how to use the estimated number of weeks to estimate your earning potential.

The Labor Market’s Effect on Travel Nursing Salaries

The labor market has an impact on wages for any profession. However, the impact of the labor market is particularly acute when it comes to travel healthcare pay.

When the travel nursing job market is hot hospitals offer more travel nursing jobs with “crisis rates” and bonuses. Both can increase a travel nurse’s pay by 5% to 35%.

Aon’s 2018 U.S. Salary Increase Survey of 1,026 U.S. companies projected an average annual pay increase of 3.1 percent for 2019. This would be the highest increase since the 2008 recession. So, an increase of 5% to 35% is massive!

On the flip side, the bill rates for travel nurses can drop during cold labor markets. For example, the average bill rate for travel nurses at California’s Kaiser Hospitals dropped from $72 to $65 in 2008.

The drop of $7 represents less than 10% of the bill rate. However, nearly the entire amount is deducted from the travel nurse’s pay. Therefore, the travel nurse’s pay reduces by nearly 15%.

Putting It All Together

As you can see, there are tons of variables that affect how much money travel nurses make. This is why we strongly believe that answering this question with something myopic, like $100,000, is a disservice to nurses everywhere.

Instead, we’ll provide a set of principles to help you determine how much money you will make as a travel nurse given your unique circumstances. We’ll also provide some real-world examples so you can run your own estimates.

Basic Principles for Determining How Much You Can Make as a Travel Nurse

To recap, if your goal is to compare how much travel nurses make to how much permanent nurses make, then here are some general principles to follow:

- If you’re paying duplicate expenses to maintain your tax home, then you shouldn’t include the value/cost of lodging when you calculate how much you can make as a travel nurse. Essentially, this is a reimbursement for a cost you wouldn’t otherwise incur as a permanent employee.

- You shouldn’t consider reimbursements for travel expenses when you calculate how much you can make as a travel nurse. These are reimbursements for costs incurred, not income.

- You shouldn’t consider license and certification reimbursements when you calculate how much you can make as a travel nurse. These are reimbursements for costs incurred, not income.

- You should exclude the value or cost of medical benefits when you calculate how much you can make as a travel nurse. Again, we typically do not add these values when discussing permanent pay packages.

3 General Categories of Travel Nurse

With all that in mind, it’s important to consider that the costs you incur as a travel nurse will depend on your unique circumstances. Generally, there are 3 categories of travel nurses. Let’s take a look at each.

Category 1: Travel Nurse with Duplicate Expenses

As we discussed above, tax-free reimbursements are typically a significant part of a travel nurse’s pay package. If your sole source of income is travel nursing contracts that pay tax-free reimbursements, then IRS regulations require that you incur duplicate living expenses.

The vast majority of travel nurses rely on travel nursing contracts as their sole source of income. Moreover, the vast majority of travel nurses receive tax-free reimbursements. Hence, the vast majority of travel nurses fall into this category.

Therefore, the vast majority of travel nurses should be incurring duplicate living expenses. We estimate that over 85% of travel nurses are in this category.

This is important! If you are in this category and you do not incur duplicate living expenses, then you may be subject to a very expensive IRS audit.

It’s important to note that duplicate living expenses vary widely. The IRS merely requires that you pay “fair market value” for rent or a mortgage at your tax home.

Tired of filling out skills checklists? They’re free on BluePipes.

Some travel nurses will pay their mortgage and various upkeep expenses on the home they own. Other travel nurses may only pay to rent a room in a shared rental property.

What is the Travel Nursing Tax-Advantage?

Finally, it’s also important to note that the tax-free reimbursements result in higher net pay for travel nurses. This is because you will pay income taxes on only a portion of your compensation.

Many travel nursing companies refer to this as “tax advantage”. It’s fair to say that the higher net-pay serves to offset the duplicate expenses that travel nurses incur. We’ll highlight the tax-advantage in our examples below.

Category 2: Itinerant Travel Nurse without Duplicate Expenses

If you do not have a tax-home, then the IRS considers you an “itinerant worker”. You cannot receive tax-free reimbursements.

However, you can still be a travel nurse without a tax-home. The travel nursing agency will simply tax all of your wages. You will not receive tax-free reimbursements. We estimate that less than 10% of travel nurses fall into this category

The advantage is that you do not have to pay duplicate expenses. The disadvantage is that some travel nursing companies may not work with you because they fear it subjects them to tax related risks and problems with overtime pay rates.

Additionally, the overall gross pay is slightly less because taxable wages subject the employer to additional payroll costs that tax-free reimbursements do not. Finally, some hospitals do not allow itinerant workers to fill their travel assignments.

Category 3: The Part Time Travel Nurse without Duplicate Expenses

As we mentioned above, it is possible for travel nurses to qualify for tax-free reimbursements without incurring duplicate expenses. However, it is quite complicated and therefore quite rare. We estimate that less than 3% of travel nurses fall into this category.

To do so, a travel nurse would work a significant portion of the year at their tax home where they pay full taxes on their income. Then, they would take short-term travel nursing assignments of 13 weeks or less for the rest of the year.

Essentially, you would be a part-time travel nurse. For example, you might work 26 – 39 weeks as a travel nurse and 13 – 26 weeks at your tax home.

This is difficult to pull off because the employer at your tax home needs to be unusually flexible with your schedule. Moreover, you need to make sure that you do not work in any one location for longer than you work at your tax home.

Given the random nature of this scenario and the minimal number of travel nurses it includes, we are not going to run annual salary estimates for it. However, if this is your scenario, then you can definitely use our examples below to help you run some calculations of your own.

How to Determine How Much YOU Will Make as a Travel Nurse

Now that we have our categories defined, let’s take a look at some real-world examples that will help you determine how much you can make as a travel nurse.

We focus mostly on Category 1 because it is by far the most common. Even if you do not fit perfectly within one of the categories above, you should be able to use the information here to account for your unique circumstances.

The Average Annual Salary for a Travel Nurse

First, we’re going to run some estimates for the average annual salary for a travel nurse. We must say that we’re not big fans of average salaries given the extreme disparity in travel nursing pay.

However, our experience indicates that the market is highly interested in these figures. Therefore, we want to oblige with a thoughtful response.

The Average Bill Rate for Travel Nurses

Of course, the average annual salary of a travel nurse starts with the average bill rate for a travel nurse. We have two indicators for this figure.

A 2017 report from the National Association of Healthcare Travelers indicates that the average bill rate for travel nurses is $67. Another report from Staffing Industry Analysts indicates the aggregate bill rate for travel nurses is $73.88.

We are going to split the difference and say the average bill for a travel nurse is $70 per hour. We’ll use this bill rate to construct the pay packages below. If you want to see a detailed breakdown of everything that goes into these calculations, then please review this article.

Benefits Included in All Estimates

Next, certain costs will vary depending on the category of travel nurse we run the estimate for. However, all the pay estimates will include the following benefits:

- Medical Benefits: $400 per month.

- Travel Reimbursement: $500 per 13 weeks

- License/Certification Reimbursement: $150 per 13 weeks

- Credentialing: $150 per 13 weeks

The costs we’ve listed above are what we see our staffing partners commonly quote for these services. If you want to see a detailed breakdown of everything that goes into a travel nursing pay package, then please review this article.

Average Annual Salary for a Travel Nurse with Duplicate Expenses and Company Provided Housing

| Hourly Value | Hours/Week | Weeks/Year | Total | |

|---|---|---|---|---|

| Taxable | $22.00 | 36 | 46 | $36,432.00 |

| M&IE Reimbursement | $9.50 | 36 | 46 | $15,732.00 | Lodging Reimbursement | $12.82 | 36 | 46 | $21,229.92 |

| Lodging Cost (Company Pays) | ($12.82) | 36 | 46 | ($21,229.92) |

| Total Rate | $31.50 | 36 | 46 | $52,164.00 |

| Estimated Tax Advantage | – | – | – | $3,146.40 |

In this example, a travel nurse takes the company provided housing. This is most often a fully-furnished 1-bedroom apartment.

Also, the travel nurse in this example has duplicate expenses that cover the cost of their rent or mortgage and basic upkeep on their tax-home. Therefore, it’s best to exclude the value of the company-housing from the value of the salary.

Discover why travel nurses are calling us their “secret weapon”.

This way, we can determine if we will make more money as a travel nurse than we do at home as a permanent nurse. To do so, we don’t count the value of housing for the travel assignment because it’s a duplicate expense that we do not incur with our permanent jobs.

As you can see, the average annual salary is $52,164. This is dramatically lower than figures you see carelessly brandished about on the internet.

However, the “tax-advantage” does add some additional money in your pocket. That’s why we highlight it here. At an estimated tax-rate of 20%, you’ll end up with $3,146.40 more in your pocket than if the money were taxed as income.

Average Annual Salary for a Travel Nurse with Duplicate Expenses and Lodging Reimbursement

| Hourly Value | Hours/Week | Weeks/Year | Total | |

|---|---|---|---|---|

| Taxable | $22.00 | 36 | 46 | $36,432.00 |

| M&IE Reimbursement | $9.50 | 36 | 46 | $15,732.00 | Lodging Reimbursement | $12.82 | 36 | 46 | $21,229.92 |

| Lodging Cost (Traveler Pays) | ($8.97) | 36 | 46 | ($14,854.32) |

| Total Rate | $37.91 | 36 | 46 | $58,539.60 |

| Estimated Tax Advantage | – | – | – | $4,421.52 |

In this example, the travel nurse takes the lodging reimbursement and finds their own housing. Many travel nurses prefer this approach because they can pocket more money.

They’re able to pocket more money by finding housing that is less expensive than the housing the company is willing to provide. The traveler pockets the difference.

This means that you may not receive the same quality of housing or you may even have roommates. We cover many other factors and risks to consider when you decide whether or not to find your own travel nurse housing in this article.

Of course, housing expenses will vary from person to person. In this example, we budgeted approximately $1,400 per month. This figure is our best guess at the average all-in cost for housing.

The average accounts for people who rent a room in a share rental as well as people who rent more expensive corporate housing. Therefore, you may experience higher or lower costs than this average figure.

As you can see, the average annual salary for a travel nurse with duplicate expenses who takes the lodging reimbursement is $58,539.60. Again, this is much lower than figures that do not take costs into account.

That said, the “tax advantage” is also higher in this example. The traveler nets $22,107.60 in tax-free reimbursements. At an estimated tax-rate of 20%, you’ll end up with $4,421.52 more in your pocket than if the money were taxed as income.

Average Annual Salary for Itinerant Travel Nurse

| Hourly Value | Hours/Week | Weeks/Year | Total | |

|---|---|---|---|---|

| Taxable | $42.35 | 36 | 46 | $70,131.60 |

| M&IE Reimbursement | $0.00 | 36 | 46 | $0.00 | Lodging Reimbursement | $0.00 | 36 | 46 | $0.00 |

| Lodging Cost (Traveler Pays) | NA | 36 | 46 | NA |

| Total Rate | $42.35 | 36 | 46 | $70,131.60 |

| Estimated Tax Advantage | – | – | – | $0.00 |

In this example, the travel nurse does not have tax home. Therefore, the travel nurse does not incur duplicate expenses. Moreover, the travel nurse cannot receive tax-free reimbursements.

Remember, this compensation package also includes medical benefits, travel reimbursements, license reimbursements and credentialing reimbursements.

As you can see, it’s fairly straightforward. The travel nurse receives only a taxable hourly wage. The average annual salary for an itinerant travel nurse is $70,131.60.

It’s important to note that the gross pay does decline a little in this scenario. The reason for the decline is that the employer’s portion of payroll taxes is tied to the taxable wage. If the taxable wage goes up, then so does the cost of payroll taxes the agency must pay.

High-End Annual Salary for a Travel Nurse

Next, we’ll take a look at travel nursing salaries that are on the higher end of the spectrum. We’ll use a bill rate of $90 per hour for these calculations. That’s $20 higher per hour than the average bill rate we used above.

Again, we include the same benefits in these calculations.

Expectations

You will encounter bill rates in this range in California and other states with a high cost of living. You might also encounter them for specialties like L&D, OR and CVICU in other states.

It is very difficult to secure ALL of your contracts at this level of pay. You can review our article on how to land the highest paying travel nursing jobs for tips.

Instead, you might expect to have one or two higher-paying contracts mixed in with one or two average-paying or lower-paying contracts in any given year. That said, it is possible to secure all your contracts at the higher level, so we’ll run the numbers below.

It’s also important to note that a small percentage of jobs have even higher bill rates than this. For example, we’ve seen bill rates as high as $120 per hour for Registered Nurses.

This means that a small percentage of jobs will pay more than our examples illustrate. We estimate that a bill rate of $90 would put the pay package for the job in the 85th percentile.

High-end Annual Salary for a Travel Nurse with Duplicate Expenses and Company Provided Housing

| Hourly Value | Hours/Week | Weeks/Year | Total | |

|---|---|---|---|---|

| Taxable | $32.50 | 36 | 46 | $53,820.00 |

| M&IE Reimbursement | $13.00 | 36 | 46 | $21,528.00 | Lodging Reimbursement | $12.82 | 36 | 46 | $21,229.92 |

| Lodging Cost (Company Pays) | ($12.82) | 36 | 46 | ($21,229.92) |

| Total Rate | $45.50 | 36 | 46 | $75,348.00 |

| Estimated Tax Advantage | – | – | – | $4,305.60 |

Again, the travel nurse in this scenario takes the company provided housing and has duplicate expenses for their tax home. Therefore, we exclude the value of the company-housing from the value of the salary.

As you can see, the high-end salary for a travel nurse with duplicate expenses and company provided housing is $75,348. We estimate that the value of the tax advantage is $4,305.60.

High-end Annual Salary for a Travel Nurse with Duplicate Expenses and Lodging Reimbursement

| Hourly Value | Hours/Week | Weeks/Year | Total | |

|---|---|---|---|---|

| Taxable | $25.00 | 36 | 46 | $41,400.00 |

| M&IE Reimbursement | $13.00 | 36 | 46 | $21,528.00 | Lodging Reimbursement | $21.15 | 36 | 46 | $35,024.4 |

| Lodging Cost (Traveler Pays) | ($8.97) | 36 | 46 | ($14,854.32) |

| Total Rate | $37.91 | 36 | 46 | $83,098.08 |

| Estimated Tax Advantage | – | – | – | $9,187.49 |

The travel nurse in this scenario takes the lodging reimbursement and finds their own housing. We budgeted approximately $1,400 per month for housing. You should expect housing to cost much more in California unless you have roommates or opt for low-level accommodations.

As you can see, the high-end salary for a travel nurse with duplicate expenses who takes the lodging reimbursement is $83,098.08. We estimate that the value of the tax advantage is $8,339.61.

High-end Annual Salary for an Itinerant Travel Nurse

| Hourly Value | Hours/Week | Weeks/Year | Total | |

|---|---|---|---|---|

| Taxable | $55.50 | 36 | 46 | $91,908.00 |

| M&IE Reimbursement | $0.00 | 36 | 46 | $0.00 | Lodging Reimbursement | $0.00 | 36 | 46 | $0.00 |

| Lodging Cost (Traveler Pays) | NA | 36 | 46 | NA |

| Total Rate | $55.50 | 36 | 46 | $91,908.00 |

| Estimated Tax Advantage | – | – | – | $0.00 |

Again, compensation is fairly straightforward for itinerant travel nurses. The travel nurse’s paycheck includes only the taxable hourly wage. In this example, the high-end annual salary for an itinerant travel nurse is $91,908.

Low-End Annual Salary for a Travel Nurse

Next, we’ll take a look at travel nursing salaries that are on the lower end of the spectrum. We’ll use a bill rate of $63 per hour for these calculations. That’s $7 lower per hour than the average bill rate we used above.

Create your free Travel Healthcare Resume on BluePipes!

Again, we include the same benefits in these calculations.

Expectations

You will encounter bill rates in this range in the South and Midwest. You might also encounter them for specialties like Psych, Post-Partum and Corrections in other states.

Again, it is very unlikely to secure ALL of your contracts at this level of pay. Instead, you might expect to have one or two lower-paying contracts mixed in with one or two average-paying or higher-paying contracts in any given year.

We estimate that a bill rate of $63 would put the pay package for the job in the 15th percentile. That said, it is possible to secure all your contracts at the lower level, so we’ll run the numbers below.

Low-end Annual Salary for a Travel Nurse with Duplicate Expenses and Company Provided Housing

| Hourly Value | Hours/Week | Weeks/Year | Total | |

|---|---|---|---|---|

| Taxable | $20.00 | 36 | 46 | $33,120.00 |

| M&IE Reimbursement | $6.50 | 36 | 46 | $10,764.00 | Lodging Reimbursement | $12.82 | 36 | 46 | $21,229.92 |

| Lodging Cost (Company Pays) | ($12.82) | 36 | 46 | ($21,229.92) |

| Total Rate | $26.50 | 36 | 46 | $43,884.00 |

| Estimated Tax Advantage | – | – | – | $2,152.80 |

Again, the travel nurse in this scenario takes the company provided housing and has duplicate expenses for their tax home. Therefore, we exclude the value of the company-housing from the value of the salary.

As you can see, the low-end salary for a travel nurse with duplicate expenses and company provided housing is $43,884. We estimate that the value of the tax advantage is $2,152.80.

Low-end Annual Salary for a Travel Nurse with Duplicate Expenses and Lodging Reimbursement

| Hourly Value | Hours/Week | Weeks/Year | Total | |

|---|---|---|---|---|

| Taxable | $20.00 | 36 | 46 | $33,120.00 |

| M&IE Reimbursement | $6.50 | 36 | 46 | $10,764.00 | Lodging Reimbursement | $12.82 | 36 | 46 | $21,229.92 |

| Lodging Cost (Traveler Pays) | ($8.97) | 36 | 46 | ($14,854.32) |

| Total Rate | $32.91 | 36 | 46 | $50,259.60 |

| Estimated Tax Advantage | – | – | – | $3,427.92 |

The travel nurse in this scenario takes the lodging reimbursement and finds their own housing. We budgeted approximately $1,400 per month for housing.

Join thousands of travel nurses on BluePipes.

As you can see, the low-end salary for a travel nurse with duplicate expenses who takes the lodging reimbursement is $50,259.60. We estimate that the value of the tax advantage is $3,427.92.

Low-end Annual Salary for an Itinerant Travel Nurse

| Hourly Value | Hours/Week | Weeks/Year | Total | |

|---|---|---|---|---|

| Taxable | $37.70 | 36 | 46 | $62,431.20 |

| M&IE Reimbursement | $0.00 | 36 | 46 | $0.00 | Lodging Reimbursement | $0.00 | 36 | 46 | $0.00 |

| Lodging Cost (Traveler Pays) | NA | 36 | 46 | NA |

| Total Rate | $37.70 | 36 | 46 | $62,431.20 |

| Estimated Tax Advantage | – | – | – | $0.00 |

Again, compensation is fairly straightforward for itinerant travel nurses. The travel nurse receives only the taxable hourly wage. In this example, the low-end annual salary for an itinerant travel nurse is $62,431.20.

What About Overtime for Travel Nurses?

To this point, our examples illustrate the standard travel nursing contract of 36 hours per week. However, travel nurses might work overtime.

In fact, a survey of hospital executives found that travel nurses work an average of 7 overtime hours per week. Therefore, we’ll provide some annual salary estimates that account for overtime hours.

“Overtime” is a loaded word, especially when it comes to travel nursing. The survey authors did not explain what they meant by it.

Therefore, we are going to assume that travel nurses work an average of 7 hours more than the 36 hours they are contracted to work. To clarify, the alternative would be 47 hours per week, 4 additional regular hours and 7 overtime hours (after 40 in a week).

However, we caution readers that overtime is not guaranteed. Also, our experience indicates that travel nurses who work standard 36-hour weeks do not average 43 hours per week as the report suggests.

That said, we use the same bill rates and scenarios for these estimates that we used above. We display only the final number for each scenario instead of providing the full breakdown.

How We Calculated the Overtime Rate

It’s important to note that overtime pay for travel nurses can be very convoluted. If you’re interested in learning more, then please review this article on overtime rates for travel nurses.

In our example, we use the “blended rate” for the corresponding pay package as the overtime rate. Some companies will pay more and others will pay less. If you’re interested in learning more, then please review this article on blended rates for travel nurses.

Also, our example counts all hours above 36 as “overtime hours”. Again, some companies pay overtime this way and others adhere to applicable state law.

How Much Do Travel Nurses Make Including Overtime?

| Travel Nurse Category | Annual Salary + Overtime |

|---|---|

| Average – Duplicate Expenses – Company Provided Housing | $67,604.70 |

| Average – Duplicate Expenses – Lodging Reimbursement | $73,980.30 |

| Average – Itinerant Travel Nurse | $90,588.26 |

| Average – Itinerant Travel Nurse | $90,588.26 |

| High-end – Duplicate Expenses – Company Provided Housing | $95,296.70 |

| High-end – Duplicate Expenses – Lodging Reimbursement | $103,046.78 |

| High-end – Itinerant Travel Nurse | $118,714.50 |

| Low-end – Duplicate Expenses – Company Provided Housing | $57,714.70 |

| Low-end – Duplicate Expenses – Lodging Reimbursement | $64,090.30 |

| Low-end – Itinerant Travel Nurse | $80,640.30 |

How do Travel Nurse Salaries Compare to Permanent Nurse Salaries?

Now that we have all these figures, we can discuss how travel nurse salaries compare to permanent nurse salaries. The Bureau of Labor Statistics reports that the median annual income for Registered Nurses was $71,730 in 2018.

Travel nursing salaries are roughly in-line with that figure when we account for all the costs. It’s possible that travel nurses may pocket more money due to the “tax-advantage”. However, travel nurses may not receive the same level of benefits that permanent nurses receive.

The Housing Wild Card

That said, it’s important to remember that the cost of housing and duplicate expenses are wild cards when it comes to determining how much travel nurses make. If you secure your own lodging for a very low price, then you can save more money. However, this is true no matter what type of employment you engage.

Also, many travelers are able to minimize their duplicate expenses. For example, they might rent a room back at their tax-home for a fraction of what a house or apartment might cost.

By reducing your duplicate expenses, you increase your annual pay in a sense. This is because the cost of the housing that you receive from the agency is much higher than what you’re paying for back at home.

For example, let’s say you rent a room back at home for $200 per month just to maintain a tax-home. Meanwhile, you live in a posh 1-bedroom apartment while on assignment. In this case, it’s reasonable to add a portion of the cost of your agency housing to your annual income calculations.

The main point here is that you’ll need to account for your own unique circumstances. Hopefully, this article helps you do so.

Will I Make More Money as a Travel Nurse?

As you can see, whether or not you will make more money as a travel nurse depends on your unique circumstances. You must consider your current salary, your duplicate expenses and other costs in order to accurately answer this question.

Discover travel healthcare jobs with the nation’s leading agencies on BluePipes.

For example, if you’re a Labor and Delivery nurse at a hospital in Northern California, then you will not make more money as a travel nurse. You’re already in the highest paying region in the country.

Similarly, if you work in a state where nurses make more than average and you will incur significant duplicate expenses, then you may not make more money as a travel nurse.

However, if you work in a state that pays lower than average wages and you will incur low duplicate expenses, then you will most likely make much more as a travel nurse. Similarly, if you’re an itinerant worker without duplicate expenses, then you will most likely make more money as a travel nurse.

Of course, let’s not forget that adventure is one of the best things about travel nursing. You can count on travel nursing for that no matter what your circumstances are!

I agree that I may be leading a less traditional career by being a travel nurse the past 10 years. The reason I do it is for the principle of knowing that when I am working, I am being paid what I am worth. Most of my contracts pay over $50 per hour and I am taxed on less than $20 of that per hour. For example, my last job paid $52.11 per hour, but I was only taxed on $16 per hour (that’s $36.11 per hour tax-free). That gave me $1300 per week in tax free money and I spent less than $400 per week of that on a hotel. I make sure to get all my assignments within 100 miles of my place, so my only housing cost is the $400 per week for the hotel between my shifts. I take home more per week than I brought home in two weeks last time I worked permanently, which was 2009. I feel the job is stressful, and we put our licenses on the line everyday. I would rather take the risk and work fewer weeks per year than a permanent nurse. I can make the same salary by working 6 months to their 12 months. I’ve also worked as an internal traveler for $70 per hour. There is a lot of opportunity to make good money if you have the skills to negotiate with the recruiters. Recruiters can also reach out to the hospital and ask for a higher bill rate if you are a highly experienced nurse. I have yet to meet a permanent nurse who can name his/her own terms as far as time off and go to Europe for four weeks like I do every year. I also make sure to take any time off I need during the 13 week contract. Once we complete those 13 weeks, we are a free agent – not beholden to anybody. That, to me, is priceless.

Thanks for sharing, Lindsey! I’m curious how the agency is paying such a high amount for reimbursements when it sounds like you’re only staying at the work location part of the week. It sounds like they’re overpaying the reimbursements in that regard because they should only pay the reimbursements for days away from the tax home. Also, it sounds like you’re in an area that has much higher than average demand for for travel nurses if you’ve been able to stay within 100 miles of your home for 10 years, working in multiple different metropolitan areas in order to maintain your tax home, all while earning higher than average pay for travel nurses. That’s great! Readers should realize that this is a very rare and fortunate situation though.

I am a retired nurse and just finished a Nurse Refresher course. My resume is impressive, I did a 3 month travel assignment in 2010 in Ocala, Fl.; but I’ve not worked in 7 years. I am anticipating Travel Nursing the beginning of 2018. This article is thorough and informatable. Thanks.

I love this. Thanks for this detailed information.

Thanks, Debby! We’re glad to hear the information is useful!

Thank you… Very inciteful and a great read. I was thunking about traveling but after reading your article I kind of feel like the recruiters that have been harrasing me from the different agencies have been trying to scam me…or bamboozle me into some scheme. Travel assignments were offered starting at like 21/hr but dont forget you get tues great incidentals and housing allowance and we reimburse your travel expenses… They quoted me like 1300/week after taxes…smh

We’re glad to hear the information was useful, Summer! $1300 per week plus free company provided housing would be okay. However, $1300 without free company housing is on the lower side. That said, the pay rate is most likely low because the bill rate provided by the hospital is low. While that doesn’t matter in terms of your pocket book, it should be considered when evaluating the agency. In other words, the agency/recruiter isn’t shady just because they offered a low pay package on this assignment…although they may be. The only way to know would be to find another agency with the same contract and find out what they’re paying for it. I hope this helps!

Thank You, that was very thorough and informative. It will truly factor into my decisions.