How To Evaluate Travel Nursing Pay Packages On Facebook

Travel nursing pay packages are complicated. The fact that different recruiters quote their pay packages in different ways adds to the complexity. In fact, the variances make travel nursing pay packages so complicated that we’ve seen seasoned executives at healthcare staffing companies get confused by them. So, in this article, we’ll breakdown 8 different travel nursing pay packages from Facebook so you can approach pay quotes with confidence.

The Confusion With Different Travel Nursing Pay Package Formats

It has become really common for recruiters to post their travel nursing pay packages on Facebook. As a result, we get to see all the different ways that travel nursing recruiters and agencies present their pay packages. This is great! However, these variances also cause confusion.

It’s definitely understandable that job seekers are confused by these pay packages. For starters, recruiters often quote pay packages without 100% of the details. For example, there may be several little calculations that the viewer needs to make in order to get the numbers in the pay quote to make sense.

Also, recruiters are often assuming that job seekers are aware of certain rules or regulations. For example, it’s quite common for us to see pay packages for California that don’t explicitly state that Overtime is paid after 8 hours in a day for a contract with 12-hour shifts.

Recruiters have some valid reasons for not including every last detail in their pay quotes. First, recruiters often lack the time to provide truly thorough written explanations for every pay package they post. However, they want to get the word out, so they post the basic information to see if anyone is interested in discovering more. Additionally, it’s easy for recruiters to take many of the details for granted because recruiters look at pay packages all day every day. As a result, there is a natural inclination to think the pay package will make sense to everyone because it makes sense to them.

Take An Inquisitive Approach To Travel Nursing Pay Packages

It’s no secret that the pay packages posted on Facebook are confusing. Unfortunately, we’ve seen various explanations of these pay packages that cause even more confusion. Sometimes, the explanations read things into the pay packages that simply are not there. Other times, the explanations fail to make vital connections that cause the explanations to present the pay packages inaccurately. As a result, viewers are often left with the impression that travel nursing recruiters are using shady tactics.

Create your free Travel Nursing Resume on BluePipes!

Look, we’re not going to say that recruiters never use shady tactics. After all, we literally wrote a book titled The Truth About Travel Nursing. We’ve written articles exposing the reality behind industry marketing messages and articles like 14 Ways Recruiters Betray the Trust of Travel Nurses.

That said, we strongly believe that shady tactics and duplicitous behavior in the travel nursing industry are the exception, not the rule. Therefore, our approach to evaluating these publicly available travel nursing pay packages is more inquisitive than accusatory. Here’s what we recommend when evaluating publicly available travel nursing pay packages:

- Use only the information the recruiter makes available in the pay quote to determine as much as you can about the pay package.

- Make a list of questions that remain and present them to the recruiter.

Essentially, we want to avoid making assumptions about the pay packages we see on Facebook. Admittedly, this is easier said than done. But that’s what this article is for!

Basic Information on Breaking Down a Travel Nursing Pay Package

Before we get started, it’s important to provide some basic information on how to evaluate travel nursing pay packages in general. If you already know how to break pay packages down, then we recommend skipping ahead to the examples.

Know the Time Variables of Travel Nursing Contract

To begin with, it’s always important to know the time variables for the contract in question. For example, the standard travel nursing contract is for 3 12 hour shifts per week for 13 weeks. That means there are 36 hours per week and 468 total hours.

The time variables are important because different compensation variables are quoted in different time increments. For example, pay quotes commonly include:

- A taxable hourly rate.

- A weekly Meals & Incidental Expenditure Stipend.

- A monthly lodging stipend.

- A travel stipend that covers the entire contract.

Meanwhile, different companies will provide different amounts for each variable. Therefore, we need to break every variable down to a common denominator in order to accurately compare pay packages. Time is that common denominator. Therefore, knowing the contract’s time variables allows us to do this.

Sample Pay Breakdown

Let’s take a look at a quick example. Suppose we get a pay package with the following variables:

- 3 12 hour shifts per week for 13 weeks.

- $25 per hour for the taxable hourly rate.

- $350 per week for the Meals & Incidental Expenditure Stipend.

- $2700 per month for the lodging stipend.

- $700 total for travel expense reimbursement.

Then, we get another pay package with the following variables:

- 3 12 hour shifts per week for 13 weeks.

- $20 per hour for the taxable hourly rate.

- $400 per week for the Meals & Incidental Expenditure Stipend.

- $3000 per month for the lodging stipend.

- $500 total for travel expense reimbursement.

You can see that all the numbers are a little different. So, how do we accurately compare these pay packages? We break all the pay variables down using a common time denominator. Then, we add them all together to get a total value that we can use to compare.

To do this, we could use hours, weeks, months, or the “total contract value” as the time denominator. Let’s use hours for this example. That’s the most common method anyway.

If we break all the variables down to an hourly figure for the first pay package, and then add them all together, we get $53.52 per hour. If we do the same thing for the second pay package, then we get $51.41 per hour.

All else being equal, the first pay package is worth $2.11 more per hour or $987.48 more for the entire contract. Of course, you’ll always want to ask recruiters what else might be included in addition to the numbers provided in the pay quote.

The easiest way to manage your travel nursing career.

It’s important to note that when we add different pay variables together like this, we get what is commonly referred to as a “blended rate”. For those who aren’t familiar, “blended rate” is a term used to describe a rate that combines two or more compensation variables.

It’s extremely important for travel nurses to understand blended rates for several reasons. First, blended rates are everywhere in the travel nursing industry. In fact, it’s fair to say that blended rates are an industry standard. Second, blended rates are the only fool-proof method of accurately comparing pay packages. Therefore, travel nurses must use blended rates even when a company doesn’t quote their rates as blended.

Please check the links below for more detailed examples and explanations of how to break travel nursing pay packages down like this.

Travel Nursing Blended Rates Demystified

Video: Breaking Down Travel Nursing Pay Packages

Comparing Travel Nursing Pay Packages

With all of this in mind, let’s break down some Facebook pay packages!

Example Travel Nursing Pay Quote: Blended Rates #1

We begin our review of travel nursing pay quotes on Facebook with a look at some pay quotes that involve “blended rates”. Again, we cannot stress enough how important it is for travel nurses to have a firm grasp of this topic. This particular pay package provides a lot of details, so it’s a great one to start with. (Link to the quote)

Here are the important variables we need to consider:

- 12-hour shifts

- 3 shifts per week

- 36 hours per week

- 13 weeks

- Located in Wisconsin

- $59.77 per hour

- $2152 “combined gross” per week

- $32.00/hour taxed

- $360 weekly meals stipend

- $640.00 weekly housing stipend

- $500 Out of state travel stipend; $250 In-state travel stipend.

- $350 provided towards medical premium

Piecing the Quote Together

When I evaluate travel nursing pay quotes like this, I first figure out how all of the numbers the recruiter provides fit together. For example, I want to figure out exactly what the recruiter is including in the “combined gross” per week. We can do one of two things with the numbers the recruiter provides in this example.

First, we can divide the “combine gross” by the hours per week (36). Or, we can divide the “combined gross” by the hourly figure ($59.77). Either way, we’re able to deduce that the “combined gross” is the product of the hourly figure ($59.77) and the hours per week (36).

Next, we need to know what the recruiter is including in the hourly figure ($59.77). First, we have an hourly taxable rate of $32. Next, we need to break the weekly stipends down to hourly values:

- $360 weekly meals stipend / 36 hours = $10 per hour

- $640 weekly housing stipend / 36 hours = $17.77 per hour

Now, if we stop here and add together, or “blend”, what we have so far, it comes out to $59.77. Therefore, we can see that the recruiter is including 3 variables in the “hourly rate” and “combined gross” per week figures she provided. She includes the taxable hourly rate, the value of the meals stipend and the value of the lodging stipend.

This is a very common approach for recruiters to use on Facebook. Essentially, they blend together the compensation components that the company is going to pay on a weekly basis. Then, they might quote some additional figures like Dianne has with the travel stipend and the medical benefits in this example.

Adding the Value of The Additional Variables

With these figures, we can take our calculations one step further. Essentially, we want to break down the remaining figures to an hourly value as well. By doing so, we’ll get closer to discovering the TOTAL BLENDED HOURLY RATE. This will help us compare pay packages to one another more accurately.

Here is what we have:

- $500 Out of state travel stipend / 468 contracted hours = $1.07 per hour

- $250 In-state travel stipend / 468 contracted hours = $.53 per hour

- $350 per month toward medical benefits / 156 monthly contracted hours = $2.24 per hour

If we add these figures to the hourly rate the pay quote provides, then we get $63.08 if we’re coming from out of state or $62.54 if we’re coming from somewhere inside the state. Again, it’s important that we factor in these additional pay variables so that we can compare pay packages with greater accuracy.

However, it’s important to note that I assumed that the company is offering $350 per month toward the cost of benefits. The pay quote specifically says, “Day one medical/dental/vision benefits ($350 provided towards medical premium). “ It doesn’t specifically say they’re paying it per month. I’m pretty certain they are, but this is exactly the kind of thing we’d want to clarify when we discuss the pay quote with the recruiter. Finally, we also want to ask the company if they will make any weekly deductions from our pay check should we choose to take their medical benefits.

Additional Questions To Ask About Travel Nursing Pay Quotes

After you run these calculations, you’re ready to contact the recruiter to find out more about the pay package. Essentially, you’re going to make sure that all your assumptions and calculations are correct. Additionally, you’re going to inquire about any additional compensation related variables that aren’t included in the pay quote.

Here are some common compensation related variables that are frequently left out of pay quotes on Facebook:

- The Extra Hours Rate (What are you paid when you work more than the contracted hours?)

- License and Certification reimbursements

- The cost of medical records like MMRs and PPDs

- Compensation for time spent onboarding with the facility

- Paid time off

- CEU costs

- 401k

Essentially, if a compensation variable is important to you and it is not included in the pay quote, then you must inquire about it. Never assume that something is included unless it’s quoted. This part of the process applies to every pay quote.

Example Travel Nursing Pay Quote: Blended Rates #2

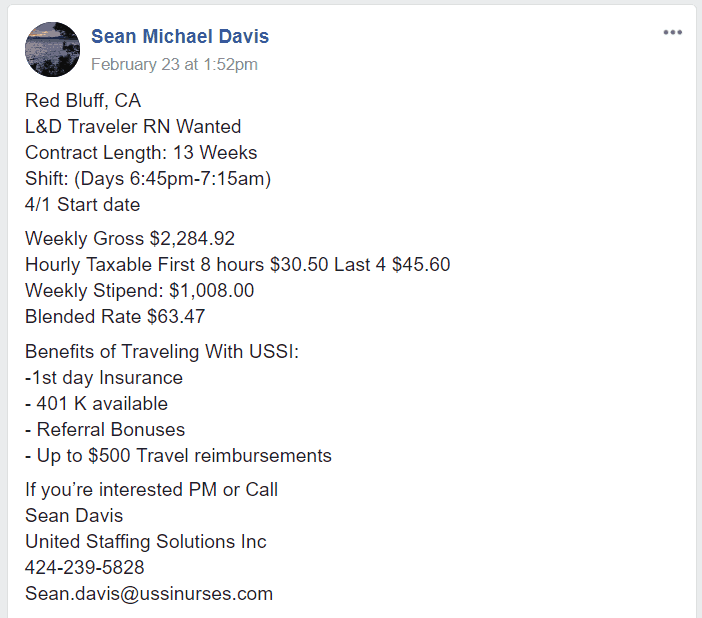

Our next blended-rate example is for a job in California. When we see a pay quote for California, we must always remember that California requires employers to pay overtime rates after the employee works 8 hours in a day and 40 regular hours in a week. Yes, there are loopholes that allow employers to avoid this requirement. However, the vast majority of agencies do not utilize these loopholes. (Link to the quote)

With that in mind, the recruiter provides the following pertinent details:

- 12-hour shifts

- 13 weeks

- Located in California

- $63.47/hour is the “blended rate”

- $2284.92 is the “weekly gross”

- $30.50/hour taxable for the first 8 hours

- $45.60/hour taxable for the last 4 hours

- $1,008 weekly stipend

- 1st day Insurance

- 401 K available

- Up to $500 Travel reimbursements

The “Weekly Stipend”

There’s actually a lot going on in this pay quote. We’re going to start with the “weekly stipend”. Essentially, the recruiter is combining the lodging stipend and Meals and Incidental stipend into one lump sum. The recruiter is likely doing this to simplify their pay quote.

However, this tactic confuses many people. For example, we saw a video on Facebook in which the video commentator insinuated that an agency offering such a quote was breaking the rules. That’s a little overboard.

Just because the recruiter quotes a pay package this way doesn’t mean that it will be paid out this way on the travel nurse’s pay check. In fact, we’re certain that the company in this example categorizes the stipends properly on their paychecks. To clarify, the company will pay one portion of this “weekly stipend” as the lodging stipend and the other portion as the meals stipend. That said, you should ask the recruiter what the value will be for each variable if you’re interested in the assignment.

The Blended Rate

Next, let’s take a look at the “blended rate”. The first thing I notice is that the recruiter has not provided the number of shifts per week. Also, he has not provided the number of hours per week. We need these numbers to make sense of everything else. Luckily, we have enough information to figure it out.

If we divide the weekly gross ($2284.92) by the blended rate ($63.47), then we get 36. Therefore, it’s safe to assume that the contract is for 36 hours per week. However, this is something you should verify with the recruiter just in case.

Next, let’s figure out what the recruiter is including in the blended-rate and make sure the numbers add up. For this quote, the weekly stipend is the easiest place to start. We simply divide the weekly stipend ($1008) by the number of hours per week (36). The result is $28 per hour.

Tired of filling out skills checklists? They’re free on BluePipes.

Next, we need to figure out the taxable hourly rate. In this case, we have two numbers, one for the first eight hours of the shift and one for the last four hours of the shift. Therefore, we want to blend these numbers together. Here’s the calculation we need to run:

- 8 hours * $30.50 = $244

- 4 hours * $45.60 = $182.40

- $244 + $182.40 = $426.40

- $426.40 / 12 hours = $35.53 per hour

So, our average taxable hourly rate for a 12-hour shift will be $35.53. If we add that to the hourly value of the weekly stipend ($28), then we get $63.53. The pay-quote offers $63.47. There is a difference of 6 cents, so we’ll need to verify with the recruiter that the numbers are correct.

Additional Questions

Next, the quote has a few items that raise questions:

- If we take the medical insurance, what’s the cost to us?

- If we qualify to receive the travel stipend, does it reduce the value of the pay package? I ask because the wording “up to $500” is a little unorthodox.

- What will the company pay for Extra Hours? Again, we shouldn’t assume that the overtime rate the pay package quotes is the rate they will pay for Extra Hours.

Finally, as we mentioned above, it’s always important to inquire about any other compensation or cost related variables that might be important to you.

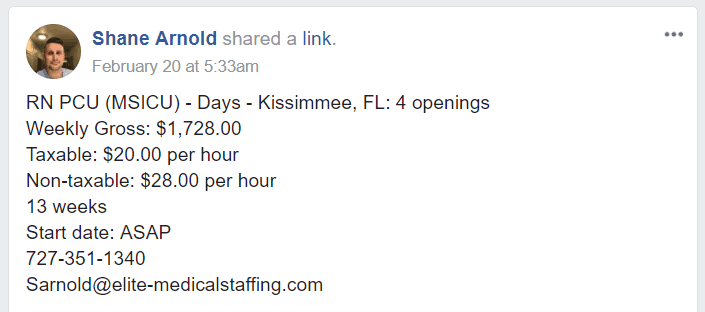

Example Travel Nursing Pay Quote: Hourly Stipends

Our next example involves pay quotes with “hourly stipends”. Essentially, the recruiter quotes the tax-free reimbursements, or stipends, as an hourly figure instead of a weekly or monthly figure. Here’s an example (Link to the quote):

In this quote, the recruiter provides the following compensation variables:

- 13 weeks

- $1728 weekly gross

- $20/hour taxable

- $28/hour non-taxable

The recruiter provides very few details in this pay quote. However, given what we’ve covered already, we’re able to discern quite a bit. For example, if we add the taxable and non-taxable rates, we get $48 per hour. If we divide the weekly gross ($1728) by $48, then we get 36. Therefore, we know that this contract is 36 hours per week or 3 12 hour shifts per week.

Confusion over Hourly Non-taxable

Overall, this pay quote is pretty basic. However, many people in the industry get confused when they see pay quotes that display non-taxable reimbursements as hourly values. There are several reasons for this.

First, many people assume that agencies that quote stipends by the hour will in fact pay stipends by the hour. This is just an assumption. It may or may not be the case.

Second, it’s widely believed that paying reimbursements by the hour violates the IRS rules that allow companies to provide tax-free reimbursements. While this is most likely the case, the reality is that the verdict is still out on this as of May, 2018. Moreover, nearly every company in the industry treats reimbursements as hourly. Some do it explicitly. Others do it with penalties for missed hours that just so happen to equal the hourly value of the stipends.

Third, when some people see a pay quote that lists non-taxable hourly values, they assume the company will continue to pay the non-taxable hourly rate when the travel nurse works Extra Hours. This is only an assumption. In fact, it’s very rare for companies to do so. And, just because a company quotes the contracted hours this way, doesn’t mean they’re going to pay the Extra Hours this way. This is yet another example of why we always recommend that travel nurses ask their recruiters specifically about Extra Hours.

You might be wondering why companies don’t continue to pay tax-free reimbursements by the hour for Extra Hours. The reason is that the government establishes maximum values for reimbursements as they’re applied in the travel healthcare industry. Therefore, an agency could potentially exceed the maximums if they pay reimbursements for Extra Hours.

Why Recruiters Quote Non-taxable by the Hour

Of course, this all begs the question, “Why would recruiters quote reimbursements by the hour?” Recruiters quote reimbursements by the hour in order to provide travel nurses with a format that they can easily compare to permanent pay packages and competing travel nursing pay packages. Ultimately, recruiters are trying to address two fundamental questions they receive about travel nursing pay packages on a daily basis.

First, travel nursing recruiters are routinely asked by aspiring travel nurses why the pay rates are so low. You see, new entrants in the market tend to fixate on the taxable hourly rate. Not a week passes that a travel nursing recruiter doesn’t hear, “There is no way I’d work for $18 per hour?! I thought travel nurses made more?!!” At which point, the recruiter must explain the hourly value of the reimbursements in order to provide a relatable figure for the aspiring traveler.

Discover why travel nurses are calling us their “secret weapon”.

Second, recruiters know that breaking every compensation variable down to a common denominator is the only way to truly compare competing travel nursing pay packages. The obvious common denominator is hours, but some recruiters use weeks or even months to quote their pay packages. Either way, recruiters are simply trying to provide as much detail as they can when they break reimbursements down to hourly values.

Example Travel Nursing Pay Quote: California

This example has several hidden variables that must be recognized in order to fully grasp how the numbers all fit together. Here is what the pay quote gives us (Link to quote here):

- 12-hour shifts

- 3 shifts per week

- 36 hours per week

- 13 weeks

- Located in California

- $1806 gross pay per week

- $21.50 per hour is the taxable pay rate

- $32.25 per hour is the taxable overtime rate

- $903 per week for tax-free reimbursements

Recognize Overtime After 8

This pay quote has two potentially confusing aspects. First, the viewer might think that they’re going to get paid $21.50 per hour for 36 hours plus $903 per week in tax-free reimbursements. However, if we do the math on that, it only comes out to $1677 per week. The recruiter quoted us $1806 per week. Is this recruiter trying to pull a fast one?!

Not at all. Instead, the recruiter is assuming that viewers will recognize that this job is in California. The recruiter is also assuming that viewers will know that California requires employers to pay overtime after 8 hours in a day. Therefore, the agency will have to pay the overtime rate for the last four hours of each 12-hour shift.

As a result, the taxable wage per week will be $903 (24 hours @ $21.50/hour + 12 hours @ 32.25/hour). If we add that to the $903 tax-free reimbursement in the quote, then we get to the gross figure of $1806. This is a perfect example of why it’s so important to dissect these pay quotes before we assume the recruiter is pulling a fast one.

Extra Time is not Overtime

The second issue that can confuse viewers of this pay quote pertains to “Extra Time”. For those that are not familiar, we like to call any hour that a traveler works in addition to their contracted hours an “Extra Hour”. Please review the video below for a detailed explanation of all the issues at play with Extra Hours.

The important point here is that many people in the industry use the term “Overtime” to refer to Extra Hours. Therefore, the pay quote above will confuse many viewers into thinking that the company will pay $32.25 for all Extra Hours worked on this contract.

We think it’s a mistake to make that assumption. The pay quote doesn’t say anything about Extra Hours. And the Overtime pay rate is clearly the pay rate for the contracted Overtime hours. It’s possible that the agency has a separate rate for the Extra Hours that they didn’t include in the pay quote.

It’s actually quite common for agencies not to include their Extra Hours pay rates in their public pay quotes. This is because many agencies have legitimate concerns regarding wage recharacterization when it comes to offering special pay rates for Extra Hours. Therefore, we advise travelers to ask about Extra Hours pay rates whenever they are not explicitly stated in a pay quote.

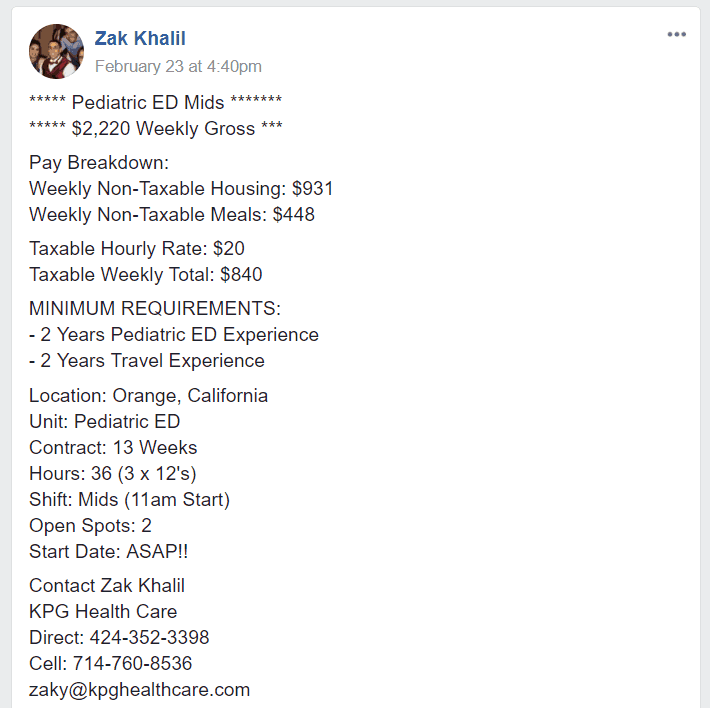

Example Travel Nursing Pay Quote California #2

This travel nursing pay quote adds a new twist on pay quotes for California (Link to quote).

The quote provides the following pertinent information:

- 12-hour shifts

- 3 shifts per week

- 36 hours per week

- 13 weeks

- Located in California

- $2220 gross pay per week

- $20 per hour is the taxable pay rate

- $840 per week total taxable pay

- $931 per week tax-free lodging reimbursement

- $448 per week tax-free M&IE reimbursement

If we add the weekly figures together ($840 + $931 + $448), then we get $2219 which is close enough to the $2220 the recruiter quoted. However, if we multiply the taxable hourly rate ($20) by the number of weekly hours (36), then we get $720. This is much less than the recruiter quoted for the taxable weekly total ($840). So, what gives?! Is the recruiter being shady?

Not at all! Instead, the recruiter is assuming we’ll recognize that this assignment is in California. Additionally, he’s assuming we’ll know the agency is going to pay overtime after 8 hours in a shift. If we make that connection, then we know that each week we’ll get paid 24 hours at $20 per hour and 12 hours at $30 per hour for a total of $840.

Everything else in the pay package breaks down and adds up correctly. As always, we would need to ask about Extra Hours, Medical Insurance, travel reimbursement and any other reimbursements we are interested in.

Example Travel Nursing Pay Quote California #3

This travel nursing pay quote gives us yet another variation of pay quotes for California (Link to travel nursing pay quote here).

Here are the main compensation variables this quote provides:

- 12-hour shifts

- 3 shifts per week

- 36 hours per week

- 13 weeks

- Located in California

- $2044 gross pay per week

- $56.77 blended hourly rate

- $21 blended taxable pay rate

- $35.77 is the hourly value of the stipends

- $1288 is the weekly value of the stipends

The good thing about this quote is that all of the numbers add up correctly. For example, if we add the blended taxable pay rate ($21) to the hourly value of the stipends ($35.77), then we get the blended hourly rate that the quote provides ($56.77). If we multiply the blended hourly rate ($56.77) by the total number of hours per week (36), then we get the gross pay per week ($2044). So far so good.

Blended Taxable Rate in California

However, the confusion might kick in when the travel nurse gets their first pay package and they see the taxable base rate is $18 per hour. The pay quote doesn’t say anything about $18 per hour, so where are we getting that from? It’s based on the “Blended Taxable Rate”.

Free eBook: How To Negotiate Travel Nursing Pay

You see, the recruiter is expecting us to see that this job is in California. And, once again, the recruiter is expecting us to know that California jobs pay overtime after 8 hours in a day. Therefore, if we work 8 hours at $18 per hour and 4 hours at $27 per hour, then we’ll average $21 per hour over the 12-hour period.

This is what the recruiter means by “blended taxable rate” in this case. He is “blending”, or averaging, the taxable base rate and the taxable overtime rate for the contracted hours. It’s important to note that we shouldn’t assume the company will pay only $27 per hour for any Extra Hours we work. Instead, we need to ask the recruiter what the Extra Hours rate is.

Example Travel Nursing Pay Quote: California OT vs. Extra Time

This pay quote is a perfect example of why we believe it’s so important to distinguish between Overtime and Extra Time (Link to travel nursing pay quote).

Here are the pertinent details:

- 10-hour shifts

- 4 shifts per week

- 40 hours per week

- 16 weeks

- Located in California

- $2727 gross pay per week

- $24.20 taxable pay rate (paid for the 40 contracted hours)

- $1759 tax-free per week

- $85 per hour “OT Rate”

Let’s use the information we have to figure out as much as we can. First, if we divide the gross pay per week ($2727) by the hours per week (40), then we get $68.17 per hour. Next, let’s see if we can figure out what’s included in the $68.17 per hour since the recruiter didn’t list this number.

First, if we divide the weekly tax-free number ($1759) by the number of hours per week (40), then we get an hourly value of $43.97. Next, if we add the hourly value of the reimbursements ($43.97) to the taxable pay rate ($24.20), then we get $68.17.

Figuring Out the Taxable Base and OT Rates

Now we get to the interesting stuff. The assignment is located in California and the shifts are 10 hours per day. As we know, California requires employers to pay overtime after 8 hours in a day and after 40 regular hours in a week. Meanwhile, the recruiter has quoted an “OT Rate” of $85 per hour. All of this begs 2 questions:

- What does the taxable pay rate ($24.20) include? Remember, these are 10-hour shifts, so they should include 2 overtime hours. It certainly doesn’t appear it includes the $85 per hour “OT Rate”.

- Exactly when does the $85 OT Rate kick in?

Taxable Base Rate

Let’s answer the first question. Any time I see a single “taxable rate” for a job in California, I immediately wonder if it’s a blended rate that includes the regular rate and overtime rate for the contracted hours. In this case, my guess is that that the taxable base rate is $22 per hour. That would make the taxable overtime rate $33 per hour. Here’s the calculation:

- 8 hours * $22 = $176

- 2 hours * $33 = $66

- $176 + $66 = $242

- $242 / 10 hours = $24.20 (the taxable pay rate quoted by the recruiter)

When Does the OT Rate Kick-in?

Now let’s try to answer the second question. When does the OT Rate kick in? Ultimately, this is a question for the recruiter to answer. The recruiter’s quote doesn’t provide a definitive answer.

Travel nurses must keep two very important things in mind when they inquire about this. First, we need to make sure we don’t confuse the overtime rate for the contracted hours ($33/hour) with the OT Rate the recruiter quoted ($85). When we inquire with the recruiter, we need to be specific. For example, “When does the $85 per hour OT rate you quoted kick-in?”

Overtime Pyramiding and Travel Nursing

Second, remember that California requires OT after 8 hours in a day and OT after 40 regular hours in a week. The latter rule confuses a lot of people. For example, this contract is for 4 10 hour shifts which is a total of 40 hours per week. In this scenario, many people incorrectly assume that every hour of a 5th shift is an overtime hour.

Unfortunately, that is not the case. The first 4 shifts accrued a total of 32 regular hours and 8 overtime hours. The law requires OT after 40 regular hours in a week. Therefore, the first 8 hours of the 5th shift are technically still regular time.

In our example here, if the agency paid Overtime for every hour of the 5th shift, then they would be “Overtime pyramiding”. This is the term labor lawyers use to describe the practice of counting the same hours against two different overtime limits. This is not against the law. Instead, the point is that employers aren’t required to pay OT this way. That’s why we need to get crystal clear answers from the recruiters about when this OT rate kicks in.

As you can see, this is quite convoluted. Again, this is why we’re such huge advocates of clearly differentiating between Overtime and Extra Time. My guess is that the company in this example intends to pay $85 per hour for any hour the traveler works in addition to the contracted 40 hours. However, we need to make certain that’s the case. More importantly, we need to make certain the contract clearly defines the rules on this issue.

Note the Unique Hours in this Travel Nursing Contract

Finally, I want to point out that this contract is for 16 weeks and 40 hours per week. It’s very important we remain mindful of these variables when we evaluate the rest of the pay package. For example, let’s say the agency offers a $500 reimbursement for travel expenses. We need to use 640 total hours when we calculate the hourly value of the travel reimbursement ($.78 per hour).

Example Travel Nursing Pay Quote: Standard OT Quote

Our next example provides a look at the Overtime vs Extra Time issue in a state with standard overtime laws. You see, the vast majority of states require employers to pay Overtime after an employee has worked 40 hours in a week. It’s plain and simple. Let’s see how this plays out in this pay quote (Link to the travel nursing pay quote here).

The pertinent details are below:

- 12-hour shifts

- 3 shifts one week and 4 shifts the next

- 36 hours one week, 48 hours the next

- Total weeks is unknown

- Located in Texas

- $1833 gross pay per week for the 36-hour weeks

- $2513 gross pay per week for the 48-hour weeks

- $20 per hour taxable regular hours

- $75 per hour taxable overtime hours

- $378 per week for Meals and Incidentals

- $735 per week for housing

- $500 for travel reimbursement

Once again, let’s start by using the information available to figure out as much as we can. First, we should try to determine what the weekly gross pay figures include. To do so, we should consider the different weeks independently. In other words, we’ll run one calculation for the 36-hour weeks and one calculation for the 48-hour weeks.

Calculating the 36-hour Weeks

Let’s start with the 36-hour weeks. We can start with the hourly value of the reimbursements. Based on 36 hours per week, the Meals and Incidental reimbursement is worth $10.50 per hour. The lodging stipend is worth $20.41 per hour. The blended-value of these reimbursements is $30.91 per hour. If we add this figure to the taxable hourly rate ($20), then we get $50.91 per hour.

Find your next travel nursing job.

Next, let’s determine the blended hourly rate for the gross pay per week on the 36-hour work weeks. To do so, we divide the gross pay ($1833) by the number of hours (36). The calculation yields $50.91 per hour. This is equal to the blended-value of the stipends and taxable rate we calculated above, which is good.

Calculating the 48-hour Weeks

Next, let’s take a look at the 48-hour work weeks. We can start with the hourly value of the reimbursements. The Meals and Incidental reimbursement is worth $7.88 per hour ($378/48). The lodging reimbursement is worth $15.31 per hour ($735/48). The total hourly value of the reimbursements is $23.19.

This is where things get interesting. Essentially, we need to figure out what the taxable hourly rate is for the 48-hour weeks. Similar to our California examples, we’re going to blend the regular time and overtime rates.

Let’s start by assuming the agency will pay us $20 per hour for the first 40 hours of the week. That works out to $800. Then, let’s assume the agency will pay $75 per hour for the remaining 8 hours of the week. That works out to $600. The total taxable pay for the week is $1400. Therefore, the blended taxable base rate is $29.17 per hour.

If we add the blended taxable base rate to the hourly value of the reimbursements, then we get $52.36 per hour. If we multiply that by 48, then we get $2513.28. That’s exactly what the recruiter quotes as the gross pay for the week.

Consider the Alternating Hours Per Week

Finally, it’s important to note the alternating hours per week in this contract. First, the recruiter doesn’t let us know how long this contract is. If it’s a standard 13-week contract, or any odd number of weeks for that matter, then the number of hours you work the first week will have an impact on the total number of hours in the entire contract.

If you work 36 hours the first week, then the total hours will be 12 hours less than if you worked 48 hours the first week. That doesn’t sound like much. However, at over $50 per hour, it’s worth over $600 in pay alone. Although, at the same time, the more hours there are in the contract, the lower the hourly values of the various other compensation variables like the travel stipend will be.

Holy Moly!!! If you made it this far, then kudos to you! You just read a 5,700-word article about travel nursing pay packages. You really care about understanding your pay packages and we hope this information helped! As always, please let us know if we missed something so we can improve the information.