6 Things Travel Nurses Should Know About GSA Rates

Understandably, there is a lot of confusion about GSA rates and how they apply to travel nursing pay. The confusion stems from the fact that including tax-free stipends as part of a salary package is pretty much unique to traveling professionals, so it’s not something we’re really used to dealing with. Additionally, there is a lot of misinformation floating around that only serves to further obfuscate the issue. In this blog post, we’ll cover some of the most common areas of confusion regarding GSA rates so travel nurses can approach the subject with confidence.

What Are GSA Rates and How do They Pertain to Travel Nursing?

GSA is the acronym for the General Services Administration of the United States Government. The GSA is a huge government agency with many responsibilities. In the simplest terms, the GSA is like a service hub for the federal government. They negotiate rates for goods and services that the US government purchases. They maintain government facilities and a fleet of over 200,000 government vehicles among many other services.

They also set the “Per Diem Rates” for the Continental United States (CONUS). “Per diem” is the term used by the GSA to refer to the maximum allowance for lodging and meals and incidental expenditures (M&IE) that can be provided to individuals while they’re traveling away from home on government business. The IRS uses the same rates for private citizens who travel away from their tax home for work. This is how per diem (tax-free money) gets applied to travel nursing pay.

It’s important to note that the Department of Defense sets the per diem rates for non-foreign states like Alaska and Hawaii while the State Department sets the rates for foreign countries. So, if you’re a travel nurse seeking per diem rates for Alaska or Hawaii, then visit this DoD website.

The terminology used to describe and discuss “per diem” and “tax-free money” is the first point of confusion. For starters, “Per Diem” is a latin term that means “per day.” It’s also a term that we use in the healthcare industry to refer to being “on-call” for work. So healthcare professionals have to get used to the double meaning here.

Additionally, there are two classifications for per-diem rates, lodging and meals and incidental expenditures (M&IE). So when a recruiter or fellow traveler uses the term “per-diem”, it’s difficult to know if they’re referring to one, the other, or both! This is why we recommend recruiters always separate them when conveying travel nursing pay packages.

Similarly, the lodging rates are often referred to as “housing stipends” or “lodging stipends.” While the M&IE rates are often referred to as “M&IE stipends” or simply “the stipend.” For the record, stipend is defined as a lump sum payment. And because agencies quote these payments as weekly or monthly values, they get referred to as stipends. In any case, travelers should be aware of these nuances to avoid confusion.

How Do I Find and Determine the GSA Rates for Travel Nurses?

Many travelers are interested in determining the GSA rates for their travel destinations so they visit the GSA.gov website to look them up. However, this too can cause some confusion. Let’s take a look at an example.

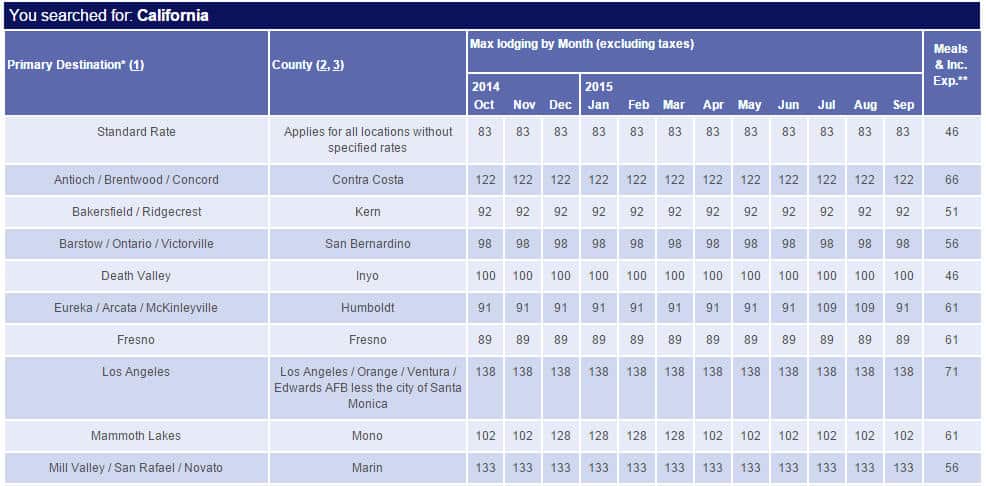

First, the GSA’s site let’s you look up rates by city, zip code, or state. We selected California as the state and the image below is a partial screenshot of the results.

As you can see, the first two columns are for Primary Destinations and Counties. Primary destinations are cities and if you aren’t able to find a a particular city on the table then you defer to the county in which the city resides.

The next column is for lodging and it’s broken down into 12 sub-categories for each month of the year. You’ll notice that the lodging column says, “Max lodging by Month (excluding taxes).” This confuses many people who wonder if the quoted rate is for the entire month or per day. It’s for each day of the month.

The reason they have lodging broken down by the month is to account for seasonal price variations. For example, take a look at Eureka/Arcata/McKinleyville and Mammoth Lakes. You’ll notice rate spikes during their peak seasons because these are popular vacation destinations during these times, but relatively mellow during the rest of the year.

The final column is for Meals and Incidental Expenditures, commonly referred to as M&IE. This is one simple column signifying the maximum amount for each day.

To calculate the maximum reimbursement allowed for lodging or M&IE simply multiply the provided figure by the number of days. So if you want to calculate a monthly total, then multiply the daily value by the number of days in the month. If you want to calculate the weekly total, then multiply the daily value by 7. For example, using the figures in the image above, you could be reimbursed up to $3,100 for lodging expenses in the month of December in Death Valley. And you could be reimbursed up to $322 per week for M&IE. Of course, this assumes that you want to spend the winter in Death Valley :-).

Should Travel Nurses get the Maximum GSA Rates?

Of course, $3,100 per month for lodging in Death Valley is a sizable chunk of change. That figure gets even bigger when we look at cities like San Francisco and Santa Monica. In fact, San Francisco’s daily lodging rate is $219 for much of the year, so the monthly total would be about $6,570! Add that to the total monthly value of $2,130 for M&IE and that’s a maximum of $8,700 per month for reimbursements.

The important thing to remember here is that these are the maximum values that can be reimbursed. Missing this crucial point can lead to confusion. For example, sometimes people get the understanding that these are the minimum values, or that it’s somehow required that these values be paid to travelers. Some even get the understanding that these Per Diem rates are actually paid to agencies by the hospital or even the government so if the agency isn’t passing this much onto the traveler then the agency is pocketing a bunch of cash. None of this is the case.

Instead, what the agency is able to pay is based strictly on the bill rate for the assignment in question. The bill rate is the hourly amount that the agency can charge for the traveler’s time at the hospital. Bill rates are typically set by the contract between the hospital and the agency. Bill rates typically vary by specialty and sometimes there are variations for years of experience or “crisis” situations. In any case, the amount that the agency has to pay for lodging and M&IE are constricted by the bill for the assignment. After all, the agency can’t pay out more than it’s bringing in or they would go out of business.

For example, let’s consider an assignment in San Francisco with a bill rate of $70 per hour, which is probably a bit more than the average for that city at this time. Now let’s say the agency pays $25 per hour for the taxable base rate and provides medical benefits and a travel stipend which would bring the total hourly value for these three variables to about $33 per hour.

Now, the maximum per diem rates for San Francisco come out to $55.76 per hour all by themselves assuming that the contract is for 36 hours per week. If the agency paid that in addition to the $33 per hour, then the total hourly value to $86.76 which is much higher than the $70 bill rate. Instead, the agency will determine how much they have left over for the lodging and M&IE stipends after accounting for the base rate and other benefits.

Why don’t agencies pay higher stipends and lower taxable rates?

This leaves many travelers wondering why the agency doesn’t just pay a really low taxable base rate, like $10 per hour, and give them the rest in tax-free lodging and M&IE payments. The reason is that IRS regulations require agencies to pay a reasonable wage to their employees. A reasonable wage is one that would be accepted under normal circumstances by someone with a similar professional status.

Ten years ago, there were swaths of agencies that were paying their travelers really low hourly rates and really high stipends either because they were unaware of the regulations or because they just didn’t care and were willing to take the risk to gain an advantage over their competitors. However, the IRS has cracked down in recent years leaving few agencies willing to take the risk. Besides, recent IRS cases have demonstrated that travelers are also at risk for penalties when they’re paid extremely low taxable base rates.

If your stipends are more than you spend, do you have to pay taxes on the difference?

Before we answer the next questions, it’s important to note that we are not tax advisers. So this is for informational purposes only and doesn’t constitute legal advice. There are many great tax advisers out there who specialize in taxes for travel nurses. Additionally, travel nurses must qualify to receive tax free reimbursements or all of the tax-free payments will be taxable on the traveler’s tax return. Finally, travelers must save copies of their contracts because they provide proof of the terms and that the working engagement was temporary. With that in mind…

Despite the fact that agencies rarely pay the maximum per diem rates, travelers are still often paid more than they actually spend on lodging or M&IE. This leaves many wondering if they are required to pay taxes on the difference. The simple answer is no, you don’t have to pay taxes on the difference.

However, there are differences between the two classifications. With M&IE, the traveler is not required to demonstrate that the expenses even occurred. It’s just assumed that you’re going to eat and drink. However, with lodging, the traveler should be able to demonstrate that at least some expenses occurred. So having a copy of the lease or your bank statements showing the payments is recommended.

If you’re reimbursed less than the maximum for lodging and M&IE and you spend more, can you write off the difference?

As demonstrated above, it’s likely that travel nurses receive stipends that are lower than the maximum GSA rates. And in some cases, the traveler may actually end up spending more for lodging and/or M&IE than they’re being reimbursed for. For example, the traveler may be paid $250 per week for M&IE which is only a little more than $20 per day. If you eat out at restaurants often, then you can quickly spend more than that in most major metropolitan areas.

This begs the question, can the difference be cited as a deduction when filing your tax returns? Currently, the simple answer is no. Unfortunately, the federal government modified the tax code in 2018 and did away with tax write offs for business expenses.

We hope you found this information useful. As always, we would love to hear your questions and comments, or have you share your experience with this topic by posting in the comments section below!

Are you one hundred percent sure i don’t have to pay taxes or declare it as an income to the difference or the stipend leftover?

Please note that we are not registered tax advisers and are only providing this for informational purposes. You’ll need to seek the advice of a registered professional to discuss your particular scenario in order to be certain. That said, if you have a legitimate tax home, and can show proof of lodging expenses, then you are not responsible for taxes on per diems (tax-free reimbursements for lodging expanses and meals and incidental expenses) as long as the amount given to you is less than the amount allowed by the GSA. I hope this helps!

How long can I stay at one facility? Can I stay in the same town if I change facilities?

Thanks for the inquiry, Brett! Before answering, I have to let you know that we’re not tax advisers, so this is for informational purposes only. We recommend speaking with a certified professional to discuss you unique circumstances. That said, there is no steadfast rule, but there general guidelines based on IRS revenue rulings. First, the facility is irrelevant. The rules apply to the municipal region. Second, if you pay duplicate expenses at your tax-home, then you should not work in the same municipal region for more than 12 months in a rolling 24 month period. If you do, then your tax-home will change to that location and you’ll owe taxes for the duration. Third, if you do not pay duplicate expenses at your tax-home, then you should not work in any one municipal region for longer than you work and pay taxes at your declared tax-home in any rolling 12 month period. Otherwise, your tax home can shift to that location or you could be deemed an itinerant worker.

We have four articles on this topic that go into greater detail for travel nurses. Links are below. I hope this helps!

Tax Home 1, Tax Home 2, Tax Home 3, Tax Home 4.

I am ready to begin my travel career but I want to make sure I understand the negotiating part. I have viewed some packages from different agencies and they all seem consistent with each other. So where does negotiating come in to play? Thank you, Debbie from Ohio

Congratulations and thanks for sharing, Debbie! It sounds as though negotiations have already begun. In fact, our take is that it’s best to keep negotiating in mind during every conversation you have with a recruiter/agency. For example, when responding to a common recruitment question like, “How much are you looking to make?” Negotiation can be as subtle as jokingly saying something like, “Well, I’d like to make a million dollars, but I’ll settle for the best pay package you can offer me.” We have many articles on this topic and we even have a free eBook with over 70 pages of content. Here are some links. We hope this helps!

Negotiation Research Travel Nurses Ought To Know About

Top 5 Ways to Improve Your Negotiating Strength as a Travel Nurse

Travel Nurse Negotiation eBook

Should You Get Raises and Bonuses for Travel Nursing Contract Extensions?

Thank you! Any and all help is appreciated!

This was so informative and thorough, It really helped me to understand some ways to negotiate my compensation in my travel contracts and what to expect and what not to expect as far as reimbursements, it also gave me a great resource to help during tax time to possibly recoup some of my expenses such as lodging, meals and incidentals, that I may not get covered in my contract. The article also made me aware of my Tax home and how to maintain it in a way that I will not get screwed at tax time, Thank you so much.

Thanks for the kind words, Anna! We’re happy to hear the information was useful. Please let us know if there are any unanswered questions we can address. If you’re interested in learning more about negotiation, we’ll be a releasing a free eBook with over 50 pages of tips and information on travel nursing pay negotiation. Connect with us on Facebook for updates!